Steadefi v2: Reboot in Safe Mode

On August 7th, the Steadefi protocol was on the verge of exponential value growth.

Our TVL was steadily rising (~$2M), and we had plans to launch new Level vaults, new LSDfi Balancer vaults, and most excitingly, our new GMX v2 vaults. Additionally the team was in the midst of a promising private round of fundraising and the $STEADY token launch was eagerly anticipated in September.

On August 8th, all of these expectations and plans came to a halt with the exploit that robbed the Steadefi users of both their personal funds and their trust in our team.

The Steadefi team will never forget August 8th and its disastrous effects, but moving forward we will also remember the hopes of the day before. We firmly believe that our platform can survive and thrive in any market conditions, and because of this, over time, we can make users whole again.

Moving forward, the Steadefi team, in collaboration with its partners, advisors, and community, will work to find upgrades and opportunity in a full relaunch, which is currently estimated for late September 2023.

Rebuilding with Knowledge Gained

The first crucial upgrade will be in operational security. For all contracts, multi-signature permissions and timelocks will be implemented for all onlyOwner functions. We will also be working with the Hypernative security team alongside other trusted consultants to give additional assessments and reviews of our operational security. Details of these upgrades will be added to our documentation.

Secondly, we will integrate Hypernative’s real-time security system into all of our vaults, both lending and strategy. This attack demonstrated to us the value of Hypernative’s service and we can now design automated emergency measures that can potentially save user’s funds from any type of attack vector, both on the opsec and smart contract level. Details of the Hypernative integration with clear examples on how their system can prevent various exploit attack vectors and scenarios will also be added to our documentation.

Thirdly, a fresh relaunch offers the opportunity for many “small” quality of life and security improvements. There are multiple ways to improve the user experience (eg, issues with 100% utilization rates) and even securer ways to design our smart contract code (eg, increased flashloan attack prevention). Better code, better security, better product.

And lastly, this gives us a chance to work more closely with our partners. With the token contracts also requiring a relaunch, we can now fully utilize Chainlink CCIP, a more secure bridging tech. Additionally, we can take the time to improve upcoming strategy vaults in light of some recent changes (eg, Level Finance 2.0 and Balancer V2 relaunch).

Compensation Plan for Affected Users

After reimbursement for the ~30% recovered by the team, there still remains ~70% of user losses in addition to the original investment value from our first seed round stakeholders. Our team is committed to our affected users and investors by using the growth and success of Steadefi v2 as the means to make things right.

We are in a “unique” situation post-exploit in that we still do not have a token. This means we do not need to create a separate “compensation token”, but can instead provide remediation through changes in our original tokenomics and emissions.

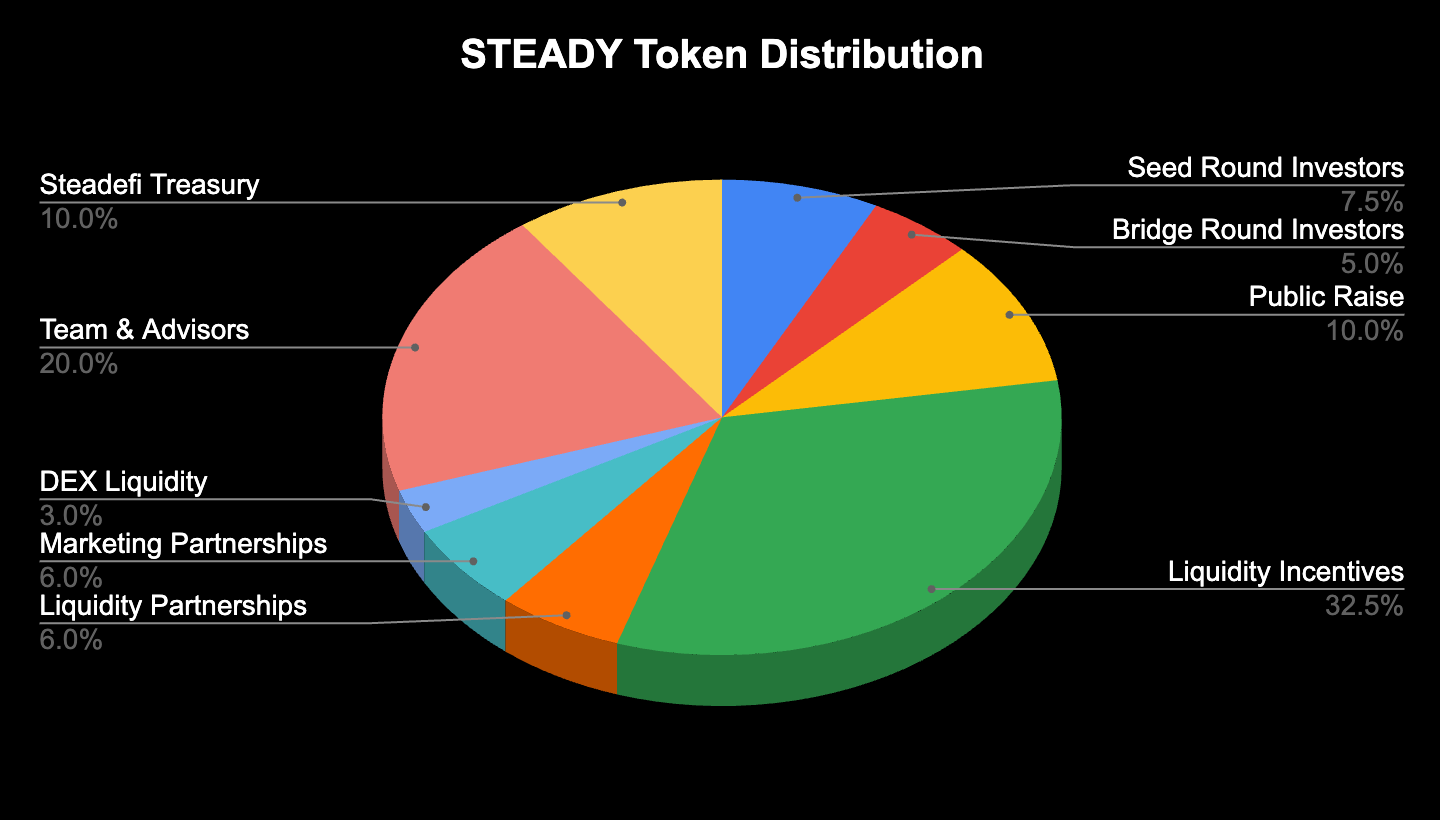

Below is the original STEADY tokenomics before the exploit

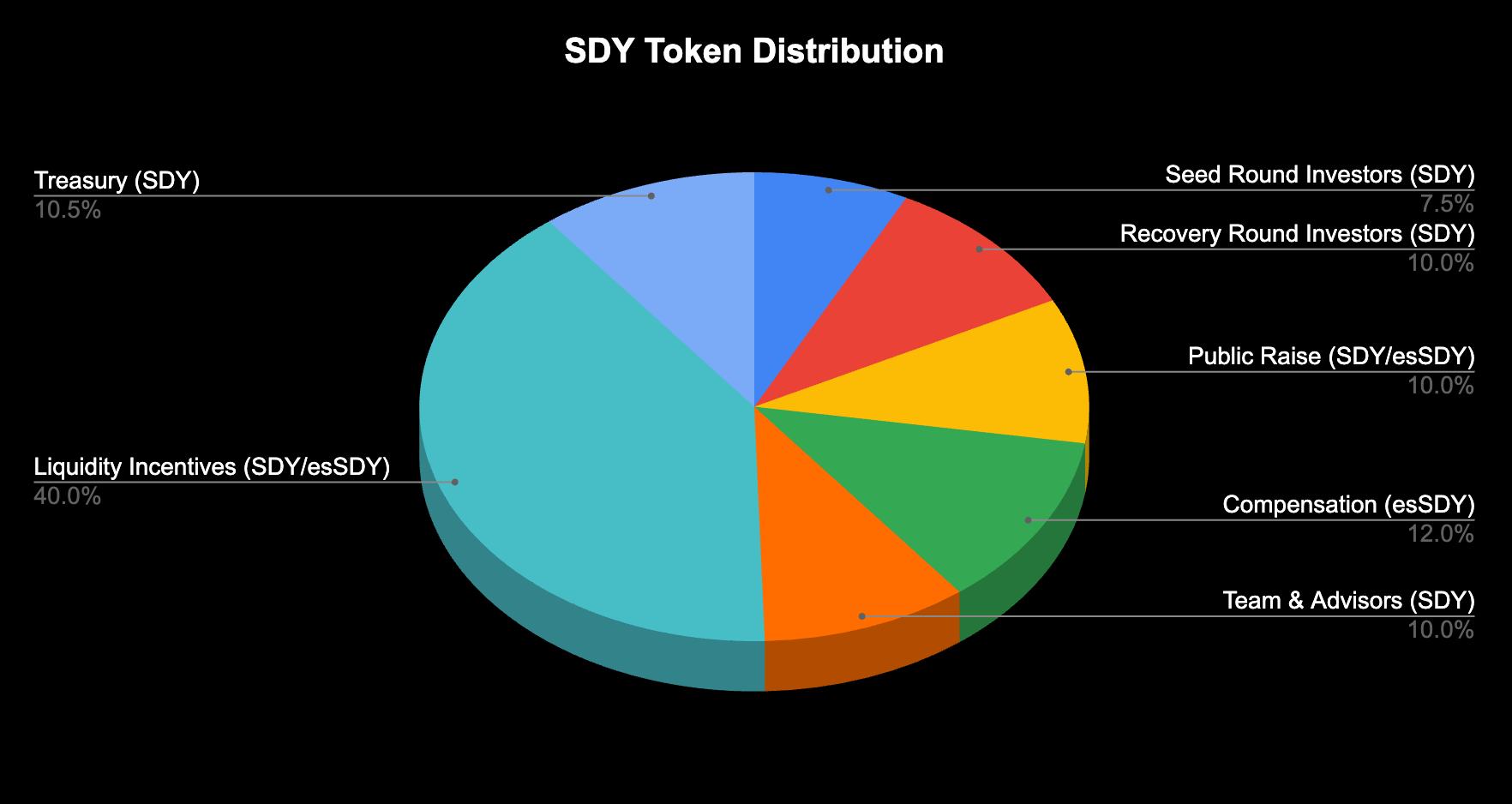

And below is the new tokenomics post-exploit (new token symbol: SDY)

Key Points:

- Compensation is 12% of the token supply with the same FDV as original seed investors ($10m).

- Compensation is in esSDY which will be claimable over a 12-month period.

- Users wishing to sell their esSDY will need to redeem to SDY on a sliding ratio of 20%-100% from 1-6 months.

- It will take up to 18 months to fully redeem 100% of esSDY to SDY, which is designed to reduce sell pressure early in a public raise.

- Previously farmed esSTEADY amounts will all be claimable in esSDY around the relaunch date.

- Users can allocate their esSDY to share in protocol revenue and/or boost yields on position.

We believe this plan is viable for making users whole in the long term while also encouraging growth and new users to our platform. In the end, we would like to emphasize that the ability to compensate our affected users is entirely dependent on the success and long-term health of the protocol.

While the basic foundation of this compensation plan is set, we understand that our community and investors will want to provide valuable feedback and suggestions for improvements. With this in mind, please join our Discord (https://discord.gg/steadefi) to speak directly with the team about this plan.

Ongoing Private Raise & Eventual Public Raise

We are currently in talks with several investors with regards to a private raise at a significant discount (see: Recovery Round Investors in table below) in order to extend the runway for the team moving forward. This extended runway will be vital to the potential success of our relaunch efforts.

We would also like to extend this Recovery Round private raise to any interested parties. If interested, please reach out to us by opening a support ticket in our Discord (https://discord.gg/steadefi).

% Supply | Token Amount (million) | FDV (million) | Token Price | Target $ Raise | Vesting (months) | |

Seed Round Investors (SDY) | 7.5% | 15m | $10m | $ 0.05 | $750k | 18 |

Recovery Round Investors (SDY)* | 10.0% | 20m | $2m | $ 0.01 | $200k | 12 |

Public Raise (SDY/esSDY) | 10.0% | 20m | TBD | TBD | TBD | TBD |

Compensation (esSDY)** | 12.0% | 24m | $10m | $ 0.05 | 12 | |

Team & Advisors (SDY) | 10.0% | 20m | 24 | |||

Liquidity Incentives (SDY/esSDY) | 40.0% | 80m | 48 | |||

Treasury (SDY) | 10.5% | 21m | 0 | |||

Total Circulating | 100.0% | 200m |

*Subject to change based on level of interest

**Subject to change based on community feedback

Please note that a public raise is still planned for the SDY token and the details of its FDV/Token Price will be determined based on platform momentum (TVL growth) and overall market sentiment. The team is targeting for TGE before the end of the calendar year.