Steadefi V3 vaults migration + Liquid Restaking strategy vaults

Announcements

Steadefi V2 Vaults migration

Announcements

Details about Steadefi’s esSDY Airdrop Campaign: how to participate, period of campaign, how to earn points and more.

Announcements

Details about Steadefi v2 secure relaunch to GMX v2 pools, enhanced security measures, compensation plan details, new investors and advisors and more.

Announcements

Introduction

Introduction of the new advisors for Steadefi v2 Secure Reboot with a focus on vaults for GMX v2 and Swell’s swETH, along with the all-important security upgrades

Announcements

Team Updates

Details of the Steadefi relaunch including a long-term compensation plan for affected users.

Announcements

Team Updates

Analysis of the Exploit occurring August 8th on the Steadefi protocol along with the outline of a reimbursement plan for recovered funds.

Announcements

Steadefi integrates the Hypernative real-time fully-integrated security platform designed to prevent and mitigate the damage from attacks on protocol smart contracts

First 7 Days of Camelot Vault Performance: Lending Vaults, plus Neutral and Long Strategy Vaults built on ETH-USDC & ARB-ETH.

Avalanche users can now earn boosted real yield in any market condition with Steadefi’s automated position and risk management.

Announcing Steadefi’s integration of Chainlink price feeds for lending and strategy vaults.

Announcements

Information and link to the $esSTEADY airdrop claim.

Announcements

Steadefi liquidity bootstrap launch. Enjoy bonus APRs in $esSTEADY for a limited time (90 days).

Announcement for Steadefi’s participation in the Chainlink Build Program

Introduction

Announcements

Featured Strategy Vault

Description of Steadefi’s GLP 3x Long Vault integrated with Gmx.io on the Avalanche and Arbitrum blockchains.

Team Updates

A Summary of our Discord Alpha Test Final Updates: Product Improvements, Final Performance Updates, Upcoming Vaults, and Discussion on GLP/Beta deposit limitations

Introduction

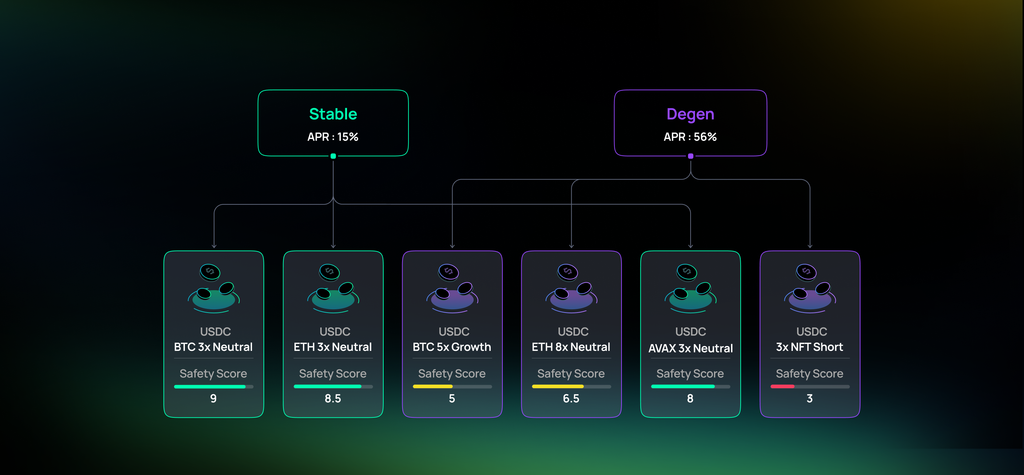

Educational

Problems of 2022 DeFi yield farming and Steadefi’s 2023 strategy vault solutions: risk management, position clarity, increased strategy options for different market outlooks.

Team Updates

A Summary of our Discord Alpha Test Updates for Week 2: Feedback on General Product, Performance Updates, Future Plans, and Discussion on APR Calculations

Team Updates

A Summary of our Discord Alpha Test Updates for Week 1: Feedback on General Product, Performance Updates, Future Plans, and a Brief AMA.

Announcements

Announcement of a successful close to Steadefi’s 1st seed round with a message of DeFi hope from the team.

Announcements

Introduction

Information about our DeFi protocol launching Q4 on Avalanche (#AVAX).

Announcements

Alpha testing information for Steadefi’s first strategy vaults.

Introduction

6 reasons for Avax: 1) Builders, 2) Yield Opportunities, 3) Need for our Strategy Vaults, 4) Expansive Support Network, 5) Vibrant Communities, 6) Institutional Interest/Onboarding

Introduction

Beginning with brief introduction to lending protocols, we show two ways in which Steadefi intends to improve upon the status quo.

Introduction

Steadefi’s approach to improving DeFi yield farming by providing 1) insight into yield sources, 2) historical trends on yield vaults, 3) APYs that match with the actual ROI.

Introduction

Steadefi’s plans to provide an optimal UX: 1) Simplified strategies, 2) Clean UI with clear indicators, 3) Full automation, no user maintenance

Two issues with DeFi Lending Protocols: 1) a mismatch in risk vs reward, 2) volatile lending APYs/APRs

This post covers 3 reasons DeFi Yield Farming fails to meet user expectations: 1) APYs tend to be based on highly-inflationary incentive tokens, 2) APYs are based on snapshots of the current market prices, 3) APYs are based on confusing manual compounding calculations.

Educational

The masses may not be coming to DeFi just yet. First, we’ll have to solve the problems of its dense jargon, intimidating user-interfaces and experiences, and insufficient transparency for wary investors.