Report on our Camelot Vaults (First 7 Days)

To view the vaults directly 👉 https://steadefi.com/vaults?protocol=Camelot

Lending Vaults

These are the engines that power our 3x strategy vaults. Single staking in ETH, USDC or ARB.

Each one is isolated to the relevant strategy vaults in order to balance out “risk vs reward”.

These APRs also include “yield sharing” from their borrowing strategy vaults.

Utilization is especially high on ETH Lending for ETH-USDC strategy vaults, resulting in a steady uptick in real yield for that vault (shown below in green 👇)

These “real-yield” lending rates don’t include the current bonus incentives in the form of $esSTEADY tokens.

Depositors to the Lending Vaults can then stake in the Farms in order to stack up our token before launch in Q3.

3x Long / Neutral ETH-USDC Strategy Vaults.

These vaults borrow from the ETH & USDC lending vaults above to create 3x leveraged positions.

The 3x Long Vault (ETH in, ETH out) is for users interested in stacking as much ETH as possible.

The Vault Token Value has seen a drop due to its exposure to ETH, but it’s still steadily accumulating more ETH for its users.

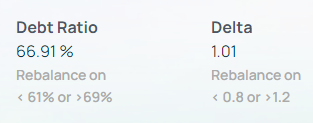

The red dot symbolizes a “rebalance” of the vault and this was done in testing before product launch. Our vault keepers will automatically perform a rebalance based on debt ratio or delta 👇

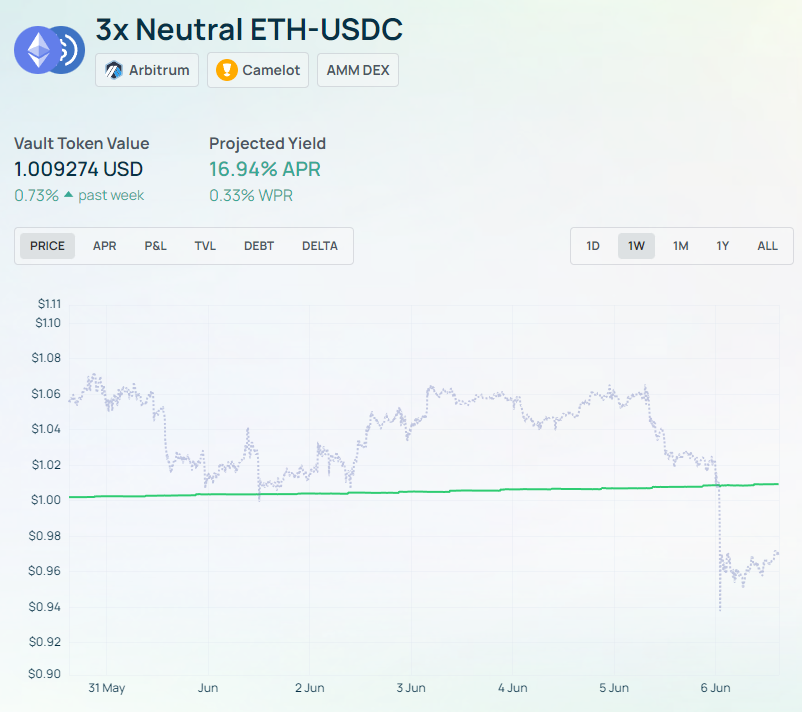

The 3x Neutral Vault (USDC in, USDC out) is for users interested in using the yields to stack USDC without being exposed to ETH market prices.

This vault has been the clear winning choice so far. ETH price (in the dotted line above) has trended downward, but the vault token price has stayed on a steady upward trend by compounding yields.

Reminder: the harvest xGRAIL is being allocated to yield boosting for the vaults, so these APRs will continue to rise!

3x Long / Neutral ARB-ETH Vaults

These vaults borrow from the ARB & ETH lending vaults to create 3x leveraged positions as well.

Note that there is a separate ETH lending pool for these vaults in order to minimize risk for lenders.

The 3x Long Vault (ARB in, ARB out) is for users interested in stacking as much ARB as possible while staying neutral to the price of ETH.

Despite a strong yield APR, this vault has suffered from the downward price action on ARB in the past 24 hours. Again, as above for the ETH-USDC Long vault, the red dots here symbolize “rebalances” which were performed in testing.

This vault is still a good choice for users bullish on the long-term market performance of ARB.

The 3x Neutral ARB-ETH Vault (ETH in, ETH out) is our final feature below 👇

Not to be confused with the pseudo-delta-neutral ETH-USDC vault above (which is actually long on USDC), this vault is essentially neutral to ARB price while going long on ETH.

This option is especially for users interested in stacking ETH through the typically higher yields of a volatile asset pairing.

ETH has dropped in price over the week, though not as much as ARB, hence the slightly better performance than the 3x Long ARB-ETH offering.

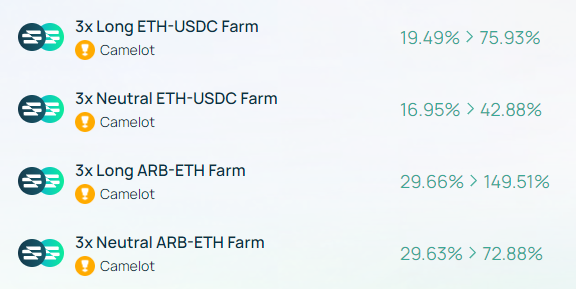

And don’t forget that all of these Camelot strategy vaults have $esSTEADY farms! 👇

Interested in any of our Camelot Vaults?

Check them out directly here: https://steadefi.com/vaults?protocol=Camelot

Follow us on Twitter: https://twitter.com/steadefi

Or join us in Discord: discord.gg/steadefi