Welcome to our 1st Featured Strategy, the 3x Long GLP!

In case the following post leaves you wanting more, please join our growing community and ask us anything at https://discord.gg/steadefi or https://twitter.com/steadefi.

This vault has been fully audited by Omniscia. Please refer to https://docs.steadefi.com/steadefi/audits for more information regarding the audit.

Click on the tabs below for more info: What is GMX and the GLP? 🧐

Read more

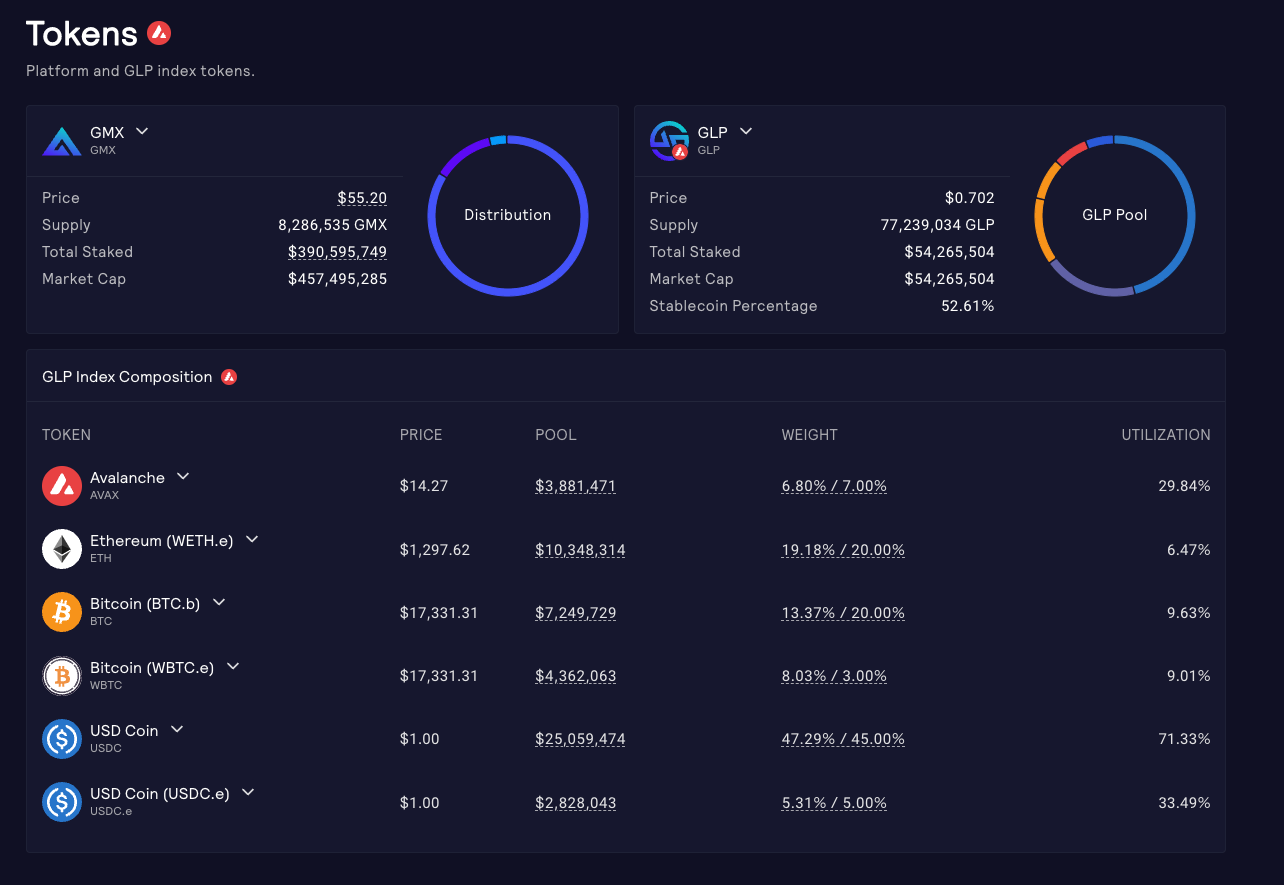

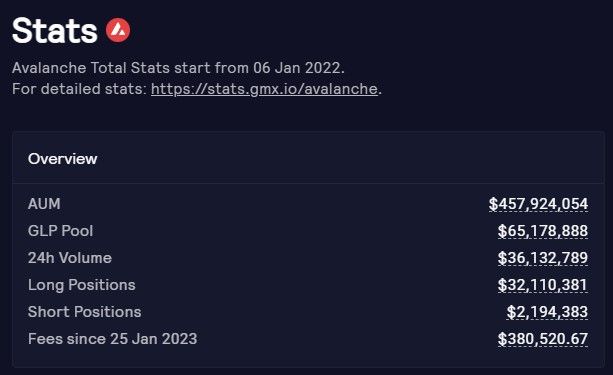

GMX is a popular decentralized perpetual exchange built on the Avalanche and Arbitrum blockchains. It allows traders to take long and short positions (up to 30x) on a selection of bluechip assets, while also providing yields to liquidity providers of these assets (GLP stakers).

The GLP is a “basket of assets”, which on the Avalanche side is composed of AVAX, ETH, BTC, and USDC.

The GLP receives 70% of GMX’s fee revenue. It also functions as a counterparty to margin traders on GMX and benefits from trader losses.

Minters of the GLP token can do so with any of the assets in the basket, but they are encouraged to deposit particular assets with variable minting fees. Essentially, the more needed a certain asset is, the cheaper it will be to mint GLP with that asset.

GLP stakers are then provided yields (in AVAX on Avalanche) from the platform’s fees on minting/burning GLP, swaps, liquidations and margin trading.

Why a 3x Long Vault on GLP? 📖

Read more

We are currently “cautiously optimistic” with our crypto market outlook. As of now (January 31st, 2023) BTC is up 38% on the month and the majority of perp traders have converted their positions from short to long.

Since it contains a nearly 50% split between stablecoins and bluechip assets, we believe GLP functions as a quality hedge during current market conditions.

If the market continues bullish, our investors can benefit from the price appreciation on the bluechip assets and the increased value of the yielded asset (eg AVAX).

However, if the market trends downward, the GLP’s stable assets help soften the impact.

Additionally, with the majority of the traders in a “long position” at the moment, a downward movement could help offset the loss in market value with traders’ -PnL.

We also believe in the long-term viability of DeFi platforms such as GMX. The recent CEX scandals of 2022 have revitalized interest in the potential of DeFi. In its current state, DeFi may not be able to compete with some of the low fees, rates and slippage offered by CEXes. However, we envision more traders will want control of their funds moving forward.

And more traders = more fees collected = more yield for GLP stakers.

Finally, we’ve seen that assets like GLP, which are low in volatility, offer optimal conditions for our closed-loop leveraging system. This means, we can safely create a balanced position that can accumulate 3x the yield of a normal GLP position.

The 3x Long GLP Vault Investor Profile 🧑💻

Read more

This vault is suitable for users that believe:

→ BTC, ETH, and other volatile assets will continue in an upward trend. 💹

→ GMX will continue to attract traders for earning fees. 🧲

→ GMX perp traders will continue to lose more than they gain. 🕗

How does the 3x Long Vault work? 🔩

Read more

AVAX Vault Example:

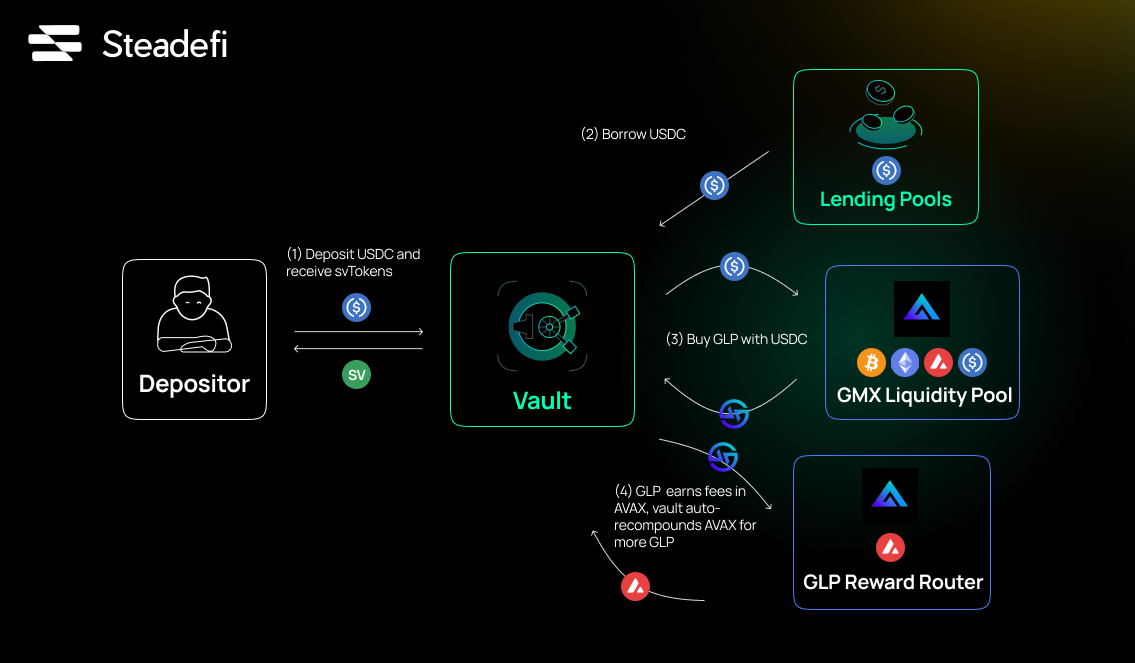

- User deposits 100 USDC to GLP Long Vault and receives svToken receipt.

- Vault borrows 200 USDC from Lending Pool. Total now 300 USDC.

- 300 USDC used to mint GLP, which is automatically staked.

- Vault keeper (bots) autocompounds the AVAX yield back into more GLP.

- Vault keeper (bots) check position status to rebalance if necessary (very rare).

- When ready, user withdraws position from the vault in USDC, which burns the svToken.

👉

Please note the normal market exposure for GLP:

$100 of GLP = $30 BTC, $9 ETH, $6 AVAX, $55 USDC

And the market exposure for our 3x Long Vault:

$100 3x Long GLP deposit = $90 BTC, $27 ETH, $18 AVAX, $165 USDC (1.32x total market exposure)

These figures are based on current GLP weights (3/7/2023) and are subject to change.

Optimal Reward Scenario 💵

Read more

Mirroring the Investor Profile, there are three primary conditions for maximum profitability:

→ slow, steady trend upward on BTC, ETH, and AVAX. 💹

→ GMX traders continue to lose more than they gain. 🕗

→ GMX continues to attract trading to earn steady (or more) fees. 🧲

Potential Risk Scenarios ⚠️

Read more

Scenario #1: GMX traders make consistent and massive gains on the platform

- Traders’ positive PnL payouts are taken directly from the GLP.

- As GLP token supply remains constant with less assets in the pool, the GLP price decreases.

- This lowers the value of the vault svToken which raises the debt ratio.

- If debt ratio passes the max threshold, the vault keeper sells GLP tokens to repay the USDC lending pool.

Scenario #2: A considerable price drop of the volatile assets (ETH, BTC, and/or AVAX)

- The GLP Long svToken value drops as the 3x exposure to the volatile assets ≠ 0.

- Since the borrow is in USDC, the debt ratio rises as the assets’ prices fall.

- If debt ratio passes the max threshold, the vault keeper sells GLP tokens to repay the USDC lending pool.

Scenario #3: An exploit, price manipulation, or code issue occurs with the GMX protocol

- An asset in the GLP may become compromised, which could artificially decrease its value or drain it completely from the GLP.

- Depending on the actions taken to counter this incident and its severity, the GLP svToken could suffer significant losses.

Backtest Results 📅

Read more

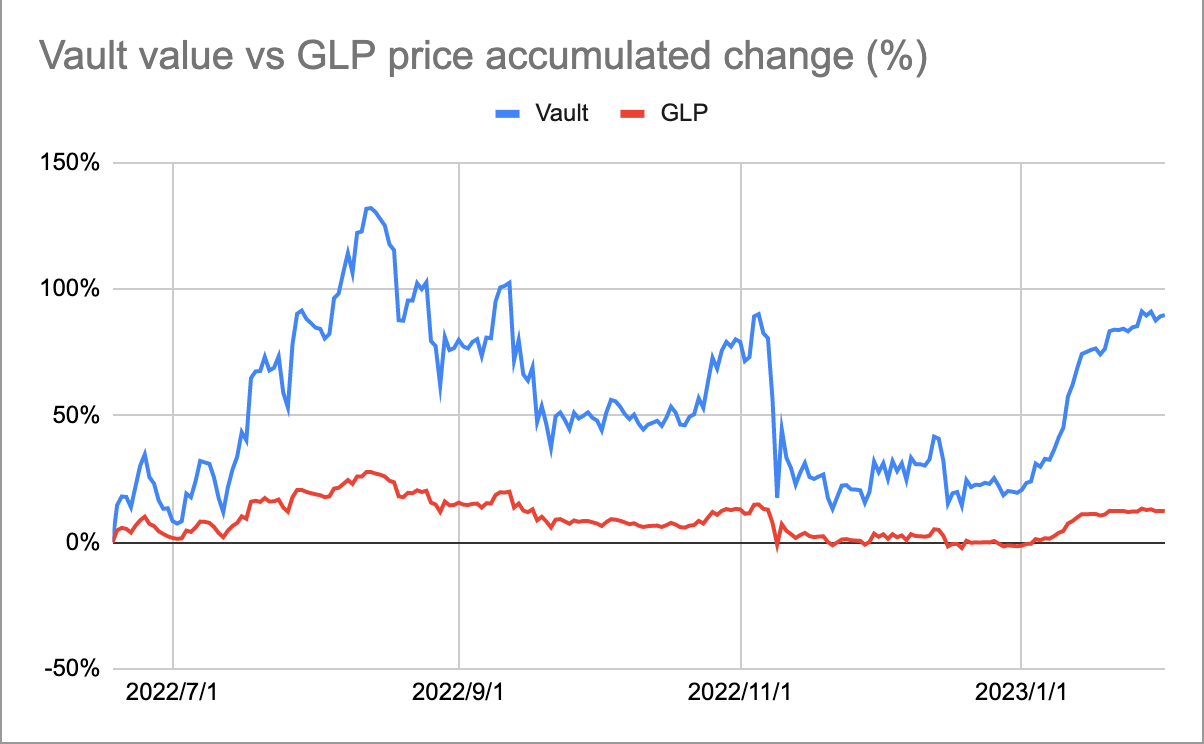

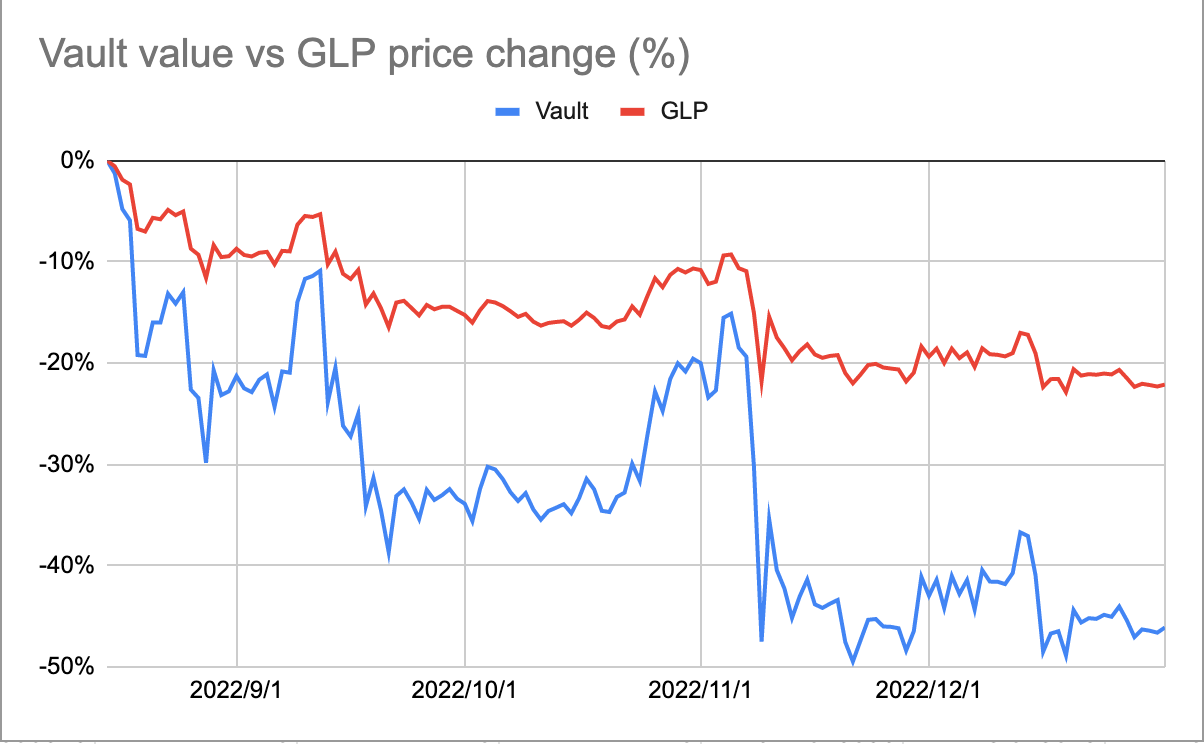

We conducted backtests from June 2022 to Jan 2023. This specific timeframe aligns more with the direction of the vault: a long view toward the basket of assets in the GLP.

In this backtest, we’ve tried to show the performance and expectations on an uptrend, downtrend and a combo of both.

1) a combo of both - from June 2022 to Jan 2023 - where BTC stayed flat.

2) a downtrend - from Jul 2022 to Nov 2022 - where BTC depreciated from US$24k to US$18k.

3) an uptrend - from Nov 2022 to Jan 2023 - where BTC appreciated from US$18k to US$23k.

#1: Combo of both uptrending and downtrending markets (2022/06/18-2023/02/01)

Overall PnL: 89.76%

GLP Overall change: 12.32%

# of Rebalances: 14

Accumulated GLP Yield: 85.52%

The Vault earned over 7x more than GLP.

#2: Downtrending market (2022/08/15-2023/01/01)

Overall PnL: -46.11%

GLP Overall change: -22.12%

# of Rebalances: 8

Accumulated GLP Yield: 19.83%

The Vault lost over 2x more than GLP.

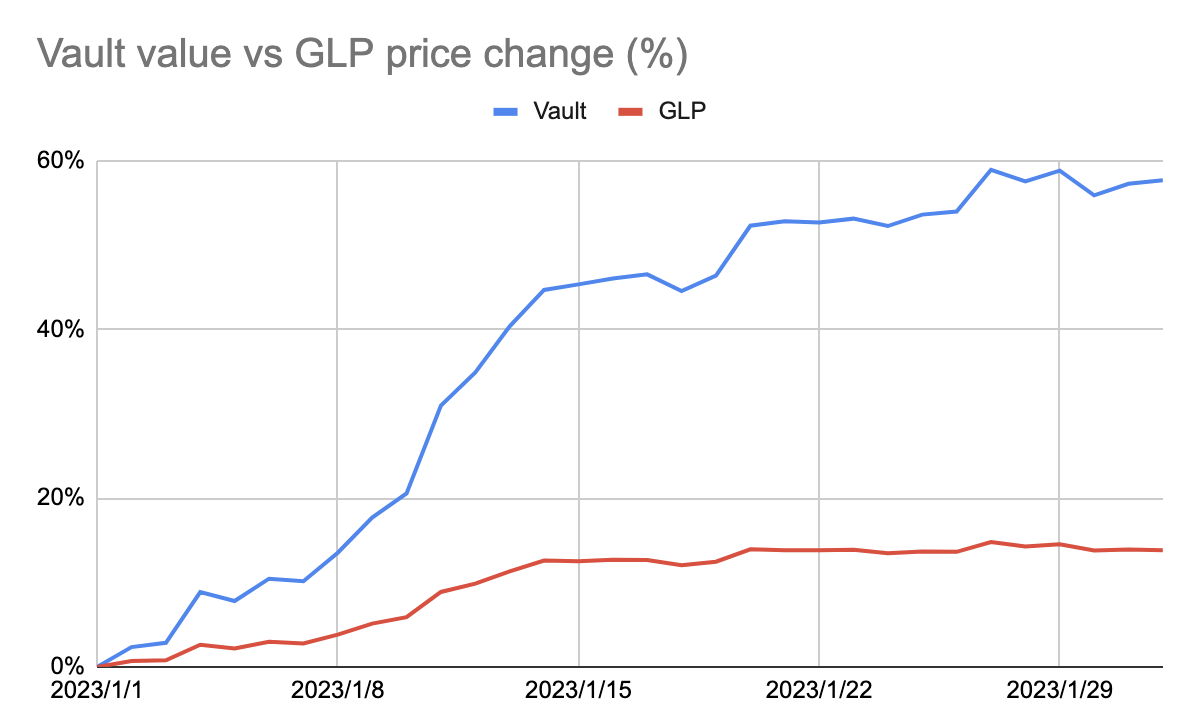

#3: Uptrending Market (2023/01/01-2023/02/01)

Overall PnL: 57.68%

GLP Overall change: 13.82%

# of Rebalances: 2

Accumulated GLP Yield: 12.38%

The Vault earned over 4x more than GLP.

Conclusions on the GLP 3x Long Vault

During a downtrending market, our vault will rebalance to reduce leverage to reduce loss.

During an uptrending market, our vault will rebalance to increase leverage + profits.

In all scenarios, the vault will continue earning and compounding to accumulate more yield to GLP.