TL;DR

- 2022 was a painful year filled with problems for DeFi yield farmers

- One glaring problem was the lack of different strategy options (most notably, market-neutral)

- Steadefi’s strategy vaults address those problems with risk management, optimized & automated yielding, and a variety of investment options that match with the user’s risk-reward profile.

A Quick Recap of 2022 DeFi Yield Farming

1) December 2021 - March 2022: Markets are “dead cat” bouncing up and farmers are trying to “enjoy” 10k% yields wherever they can.

2) Late March - Late April: Farmers start feeling some pain as market heads south. They remain in the game, however, hoping that 10k% yields can cover their position losses.

3) May - October: Brutal mass liquidation events + complete chain collapses + exploits and hacks + (un)expected scandals + CEXy insolvency = farmers demoralized and crushed.

4) November - Now: The few surviving farmers emerge from the wreckage to salvage whatever (few) funds remain. Coincidentally, a new DeFi trend emerges: “Market-Neutral Vaults”.

The Problem with the Past

One core issue made clear this past year was that yield farmers were only presented with a single choice for their yields, i.e., a single “market outlook”. With the market in the midst of a year-long bull-run, (almost) everyone was decidedly “bullish” with their strategies.

Unfortunately, the consequences of having only one choice were severe.

Enter 2023 and the Steadefi Strategy Vaults

Our vaults offer 3 things these rekt yield farmers need:

1) Risk Management

2) Automated Yield Optimization

3) Clear Strategies for Different Market Outlooks

Risk Management

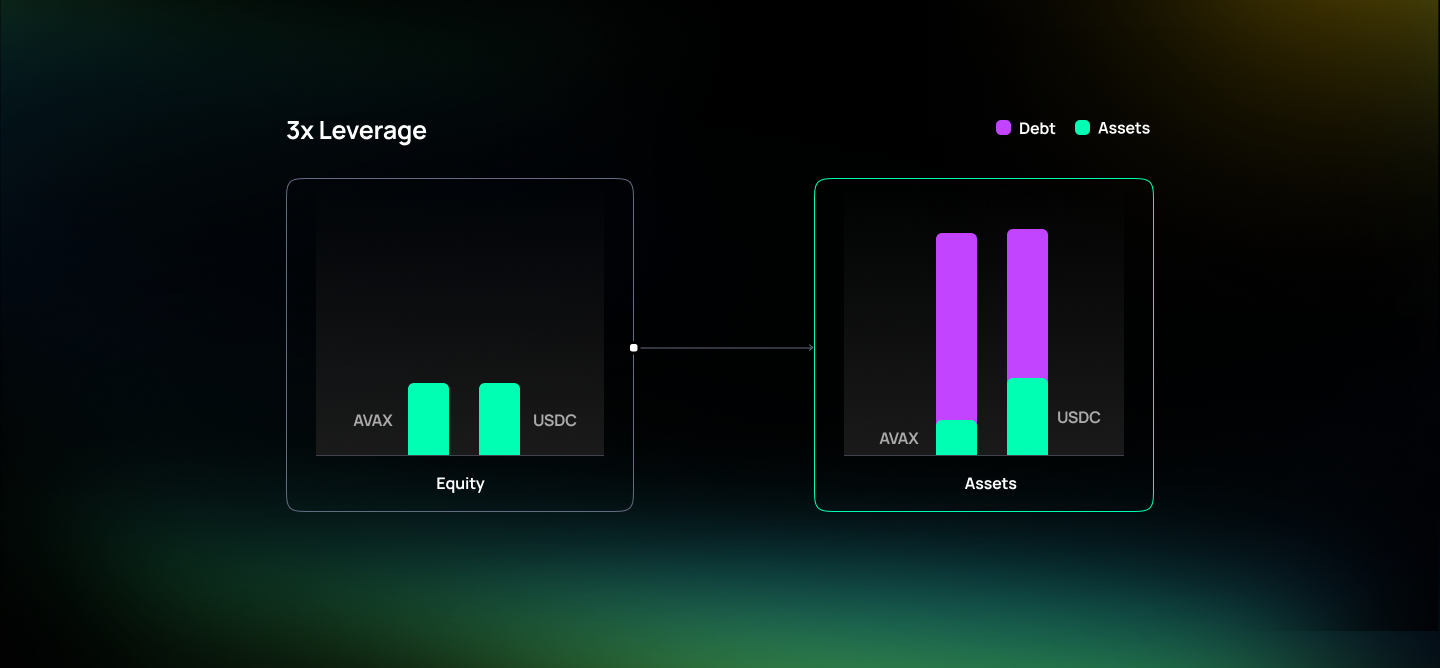

One of the main ways to manage farming risk is by hedging your initial position. This means that instead of simply buying an asset and hoping that it will increase in value (LONG), the farmer can take multiple stances at once (both LONG and SHORT) that effectively balance each other out.

The key here is that market-neutral farmers do not want to worry about the value of their equity, but instead, they only wish to focus on gaining profits slowly through the yields this equity earns.

The next way to manage risk, particularly in leveraged yield farming (LYF), is by maintaining protection against “bad debt-ratios” and/or “liquidation.” One of the previous dangers of LYF was when the amount of debt, and the interest paid on that debt, trapped them in positions where they were forced to manually deleverage, pay back the debt with outside funds, or suffer outright liquidation (typically 10% of their position value).

This risk can be managed through “automatic rebalancing”. An evolved yield strategy vault can prevent “bad debt-ratios” or liquidation through automatic deleveraging and balancing out the volatile asset with the stable asset.

Essentially because Steadefi retains strict control over the source of the collateral assets, the leveraging of our vault users, and the liquidation function itself, we can effectively manage this risk for our users.

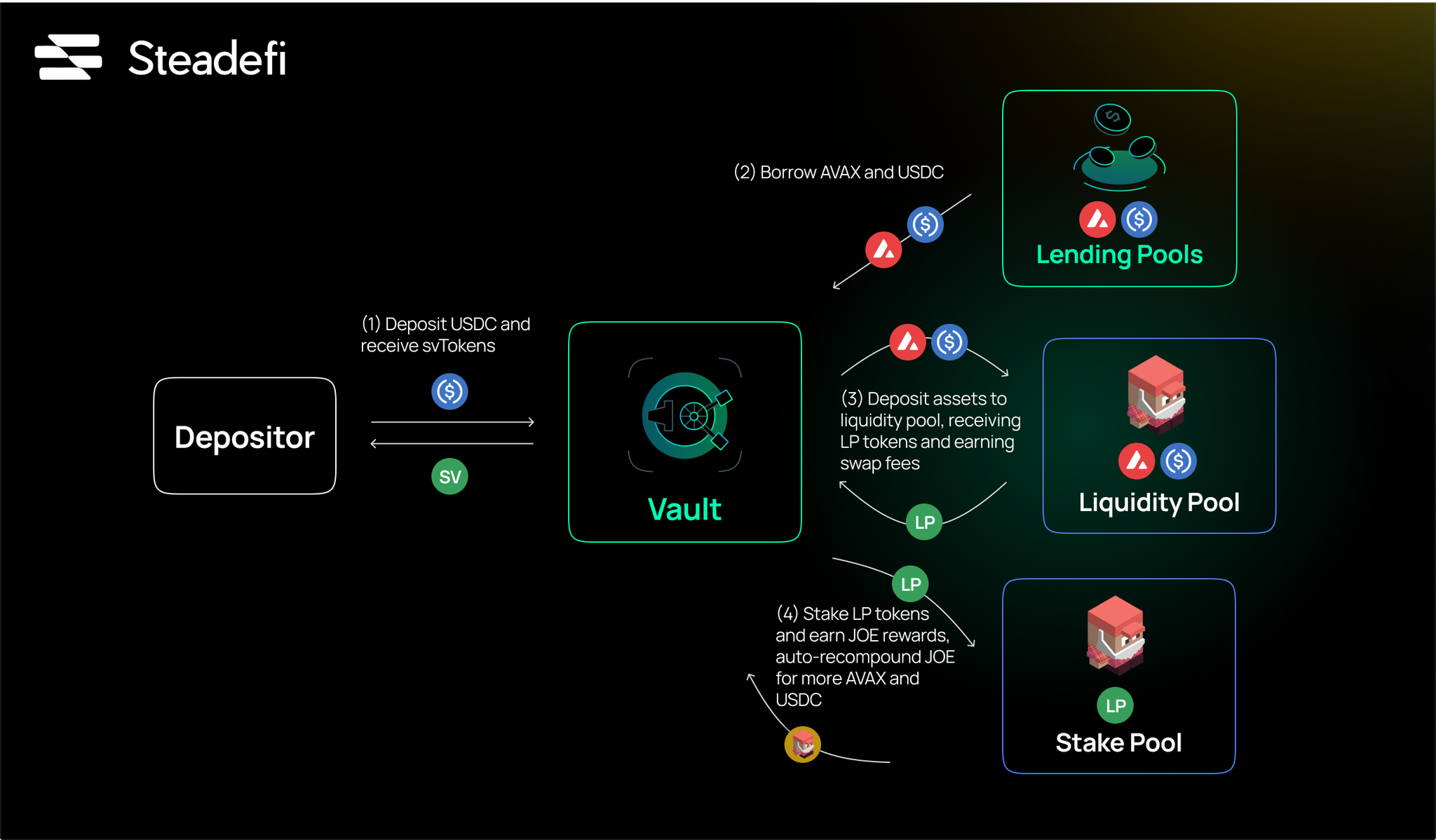

Automated Yield Optimization

Another way for farmers to maximize their yields is through autocompounding. This concept was not new to 2022, but the addition of “market-neutrality” will show its true power for real growth over time.

Using the power of undercollateralized leverage (at least 3x), your vault positions will gain the autocompounding of both the earned swap fees AND the reward emissions from the underlying yield source.

Clear Strategies

Steadefi’s vault page (and eventually the lending as well) will provide yield farmers the clarity and sense of direction they’ve been missing the last two years.

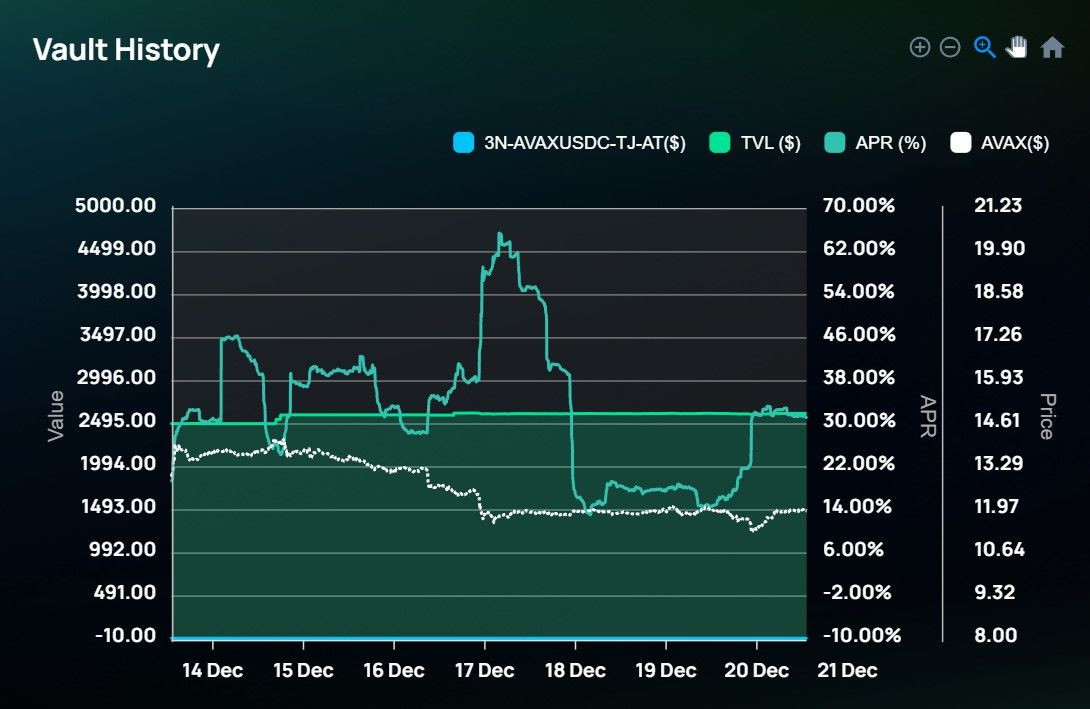

First, the clarity will come with the visualization of data and transparency.

In previous generations, when a user approached a farming pool/vault, they were commonly provided with misleading metrics such as “APYs” (or the infamous “lambo calculators”). These data points lack historical transparency (e.g., how has this pool performed over time?) and they also suffer from misguided forecasting (e.g., this is the price now, this is the emission rate now, so this is how many lambos you will receive a year from now).

2023 yield farmers are going to be a savvy, cynical bunch. They will demand clarity (past, present and future) regarding any position they take.

Steadefi aims to meet those demands:

On top of the data clarity, with Steadefi’s strategy vaults, yield farmers will finally be able to formulate and take action based on their views of the crypto markets.

NEUTRAL vault → does the farmer believe the markets will continue sideways or downward with low volatility and a decent flow of swaps over time?

LONG vault → does the farmer believe the markets will slowly trend upwards in the long run with hopes of stacking as much as possible of a preferred asset (such as AVAX)?

This is only the beginning of the choices our friendly yield farmers will be able to enjoy: would you like to long or short market volatility? Would you like leverage up on liquid staking? Would you like to go market-neutral on a basket of bluechip assets?

In the end, our main mission is to help that sad rekt 2022 farmer turn into a smart-hedging, real-yielding, happy unrekt farmer in 2023.

If you’d like to learn more, please join our discord: https://discord.gg/steadefi and follow us on Twitter: https://twitter.com/steadefi