We have two different DeFi users, Mr. Degen and Mrs. Safe.

Having mastered the lingo and UX of the DeFi space, Mr. Degen feels confident enough to pursue only the highest yields on his principal, no matter the consequences.

Mrs. Safe, however, has suffered too much from unpredictable yield farms. She no longer wants the highest APRs and would rather earn a lower, stabler return on her investment.

Can they both implement their strategies on the current iterations of lending protocols?

No.

But why not?

Reason #1: Unfair distribution of rewards.

The risk vs reward of yield farming opportunities is somewhat fairly distributed. The safest yield assets (blue chips & stablecoins) usually provide 1–3% yields and the riskiest assets (farm incentive or seigniorage tokens) provide 100%+ APY/APRs (or sometimes in the billions 🧐).

With lending and leverage protocols, however, there are fewer opportunities that match up with the investor’s risk-reward preferences.

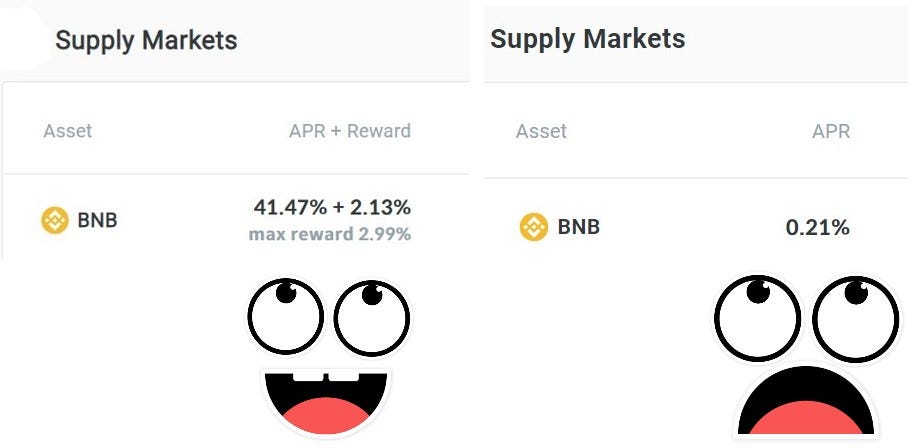

When both Mr. Degen and Mrs. Safe go to a lending site, they’ll only see one pool or vault for depositing their assets.

Yet in the example above (for leveraged yield farming platforms), the supplied assets are being used for all types of leveraged borrowing, some conservative (2x) and some much more aggressive (8x), but the rewards for both lenders are spread evenly into these single pools/vaults.

To both our users, this doesn’t seem fair…

Mrs. Safe is a “conservative” lender, so why should she be exposed to the same risks as Mr. Degen?

And as the “aggressive” lender, why should Mr. Degen be forced to share his rewards with Mrs. Safe?

Reason #2: Volatile Lending APY/APRs

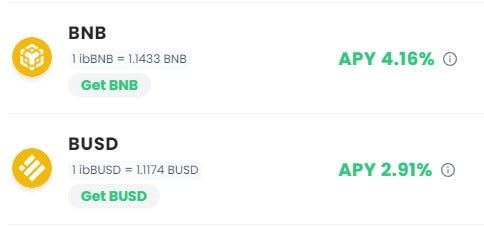

Yields for supplied assets are continually fluctuating day to day.

One day Mr. Degen might yolo his BNB into a 43% APR and the next day it’s 0.2%. So then he has to move his funds to a different pool or different protocol to continue getting that “sweet yield high”.

And poor Mrs. Safe is even more stressed out about these shifting APYs. She’s trying to get a safe little 2% APY on her ETH, but suddenly the next day she finds it at 15% and then the next day at 0.5%— all still great returns over time of course, but Mrs. Safe is not a fan of anything dramatic, especially her APYs.

Fluctuating APY/APRs aren’t necessarily the worst thing in the world for an investor since it doesn’t usually entail more risk (excluding extreme circumstances like exploits).

But users should be given the choice between something more fixed and steady, or something more dynamic and volatile.

In the end, Mr. Degen should be able to chase the yield dragon while Mrs. Safe cuddles up comfortably with a warm cup of stable tea.

Interested in learning more about Steadefi and our upcoming products?

Follow us on Twitter! https://twitter.com/steadefi

Interested in participated in our limited Q4 Alpha Testing?

Join our Discord! https://discord.gg/steadefi