In our previous post, we covered why DeFi struggles with bringing in the uninitiated masses.

Now what about the initiated masses? Let’s say that they know a bit about the DeFi terms and concepts and maybe they are comfy navigating the mysteries of web3 finance.

The next step is coming to terms with one of DeFi’s primary incentives (and problems):

Misleading and unpredictable Return-on-Investments (ROIs) — typically presented as Annual Percentage Yields (APYs) or Annual Percentage Rates (APRs).

To illustrate this issue, let’s take a brief journey through what we’ll call the “Land of Unexpected Losses”.

The first step in this journey typically starts in a Centralized Exchange (CEX) such as Binance.

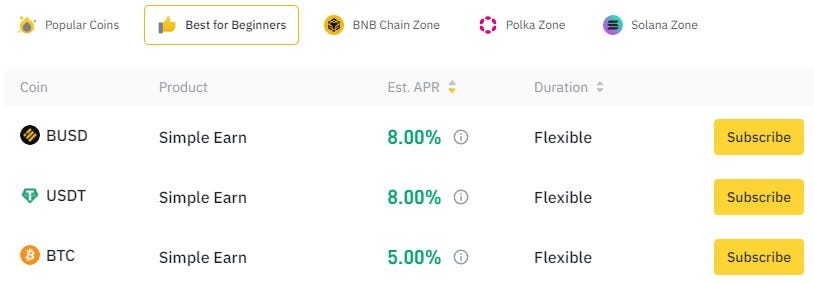

After onboarding from paper currency onto a CEX, a user can purchase a stablecoin or Bitcoin (BTC), for example, and subscribe to simple interest rates (shown below).

First off, these “high” yields are only for small amounts (e.g., 1–1000 USDT for 8%).

Secondly, we need to keep in mind that the APR shown for something like BTC reflects the yielded return in the form of more BTC. So if you invest $40k into BTC valued at $40k and then BTC drops suddenly to $20k over the next year, you aren’t truly gaining a 5% return on your original $40k investment.

And finally, we have these “eye-catching 8%” returns on the USD stablecoins — but let’s take a quick peek at the current US dollar inflation rate….8.26%.

Hmm…so these returns are certainly better than a traditional bank, but still not enough for the risk the user is taking on.

So these CEX yields aren’t enough!

The second step in our journey comes when our new user seeks more control over their assets and/or “higher returns” than what a CEX is offering. They move their funds into DeFi, perhaps in this case, the Binance Chain.

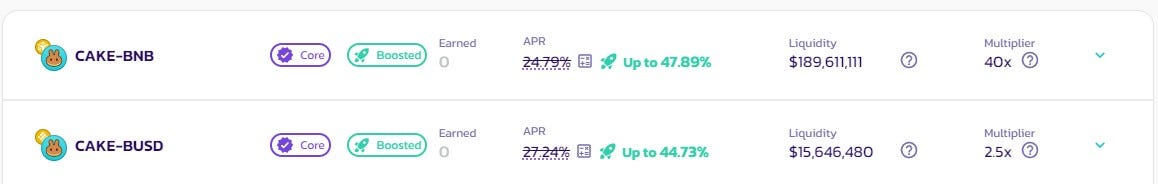

On the blockchain, they may end up finding the APR/APYs more attractive with a protocol like Pancakeswap (Binance Chain’s largest decentralized exchange, or DEX).

APRs of 44–48%! Much better, right?

Now they have to buy a different token called CAKE — which is a little annoying — but still, the APRs are 5–8x higher than the CEX, so that should balance out the risk of purchasing a desert-themed token…right?

Not so fast — just as with Step 1, the actual ROI is entirely dependent upon the value of these CAKE tokens after 365 days. If the CAKE market tanks from $40 to $5 (which it did), the user’s original $40k USD has not returned that sweet 40%+ APR.

“Well OK, so perhaps the value of the farming asset isn’t the issue,” a new user might think. “Perhaps the APRs here are just too low.”

So we move to the third step in our journey: High-yield hunting.

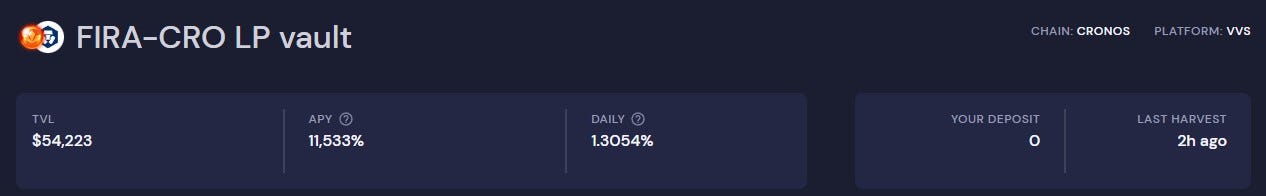

Multichain autocompounding farms, like Autofarm and Beefy, are offering insane yields on some of their vaults.

350% APY? Wow.

Or wait, 11.5k% APY?! Now we’re about to make some money, right?

If we take our $40k USD and drop it into that 11.5k% FIRA-CRO LP vault, we are going to end up with…hold on…need to get a napkin for some math…

$460,000,000 in 365 days.

Not. too. shabby.

OK. So it’s safe to assume that not every DeFi investor (or any) is going to end up 11,500x on their principal in 365 days.

But why not? What goes wrong over those next 365 days that turns the $40k to $5k instead of $460M?

Why do APYs/APRs not meet expectations?

Failed ROI Reason #1: The APYs/APRs are based on highly inflationary incentive tokens.

Some DeFi protocols need to find ways to attract buyers to their tokens. In order to do so, they quickly distribute and thus inflate the circulating supply of their tokens at crazy-high rates, which…never ends well for investors, especially those that buy early…

Failed ROI Reason #2: APYs/APRs are based on current market prices

Everyone around the world, even the casual bystander, knows now that cryptocurrencies are an extremely volatile asset class. This may be great for day-trading addicts and chart analysts, but for an average user like our grandpa it can be both stressful and overwhelming.

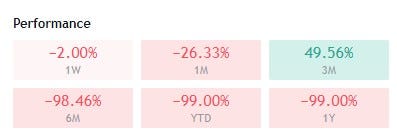

Token prices will fluctuate immensely within one year (see example below), which means no APYs/APRs are safe or predictable.

This example from JEWEL is just one of a million of the same. Good for those people that bought 3 months ago! Rest in peace to anyone buying 6 months ago. No amount of crazy high APYs can keep up with that kind of volatility.

Failed ROI Reason #3: Many APYs are based on manually compounding and confusing yields

APY/APR numbers are merely extrapolating a value that is a current snapshot in time. For example, if the daily ROI is shown as 1% today (which sounds crazy, but this exists), the APR/APYs appear extra large because it compounds that 1% for one whole year at unknown intervals.

Plus, things get more complicated with different types of vaults and farming. In the example above, we have an APY of almost 271% which requires a deposit of the UM-UMF LP, but then the rewards are distributed (perhaps randomly) in the form of USDC…and sometimes UM?

Can our user really reach a 271% return with this?

Can our user be expected to sit down hourly, daily, weekly, to figure out the optimal moment to compound his yields in order to reach an ever-fluctuating overblown APY target?

Probably not. They might just wait for something better…

Interested in learning more about Steadefi and our upcoming products?

Follow us on Twitter! https://twitter.com/steadefi

Interested in participated in our limited Q4 Alpha Testing?

Join our Discord! https://discord.gg/steadefi