The current bugs and shortcomings of DeFi are many.

Bug #1: the mechanics and terminology are intimidating.

Bug #2: the user experience is not intuitive or fully transparent.

Bug #3: position management is tedious.

Initially we wanted this week of posts to provide our solutions to the “bugs” presented in last week’s series.

But in DeFi, there are no proven solutions — not yet. No iteration of a blockchain or a protocol is going to be instantly perfect and complete. They require continuous development and maintenance.

Essentially, the entirety of DeFi is still in Beta mode.

Steadefi hopes to patch some of DeFi’s bugs and become a part of DeFi v3.1A (“A” is for alpha).

DeFi Simplified: One-click Strategies

No doubt about it — DeFi terminology is an overwhelming challenge.

Although there are attempts to communicate its complexity in easy-to-understand language or real-world analogies, most often these attempts leave the new user even more lost than before.

An example of a well-meaning analogy:

A liquidity pair can be “apples and oranges at the market”, arbitrageurs can be “apple and orange market inefficiency experts” and a flash loan can be “a miraculous tornado of apples that disappears as quickly as it comes.”

Does that help?

Instead of forcing users to grapple with all of these terrible analogies, we’d like to offer a way around them. Almost everyone entering the DeFi space should have a “market view” — where do they see things moving in the long run? Up, down or sideways? If a user has this then we can provide simple one-click strategies that connect to their market view.

Clearing up the User Experience

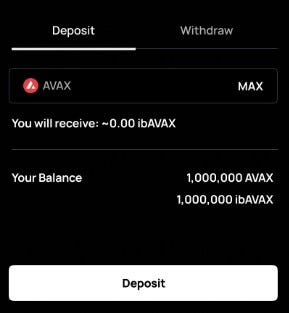

We’re working to keep our UI clean by maintaining a clear separation between actions and information.

Above are the actions.

Below is the information.

We’re also working to illustrate for users how a pool or vault has performed over time.

Automating Position Management

Users won’t be required to manage their positions with us. At all.

Their only responsibilities will be to choose their preferred vault, decide how much they want to deposit and then deposit the funds.

The rest is our responsibility.

Interested in learning more about Steadefi and our upcoming products?

Follow us on Twitter! https://twitter.com/steadefi

Interested in participated in our limited Q4 Alpha Testing?

Join our Discord! https://discord.gg/steadefi