Click on the tabs to read more!

Feedback: General Product Updates

- We received overall positive feedback on our User Interface and User Experience

- On mobile browsers (mobile chrome, safari, on both iOS/Android) things did not load.

Action: We display a message if we detect that a user is accessing our protocol using a mobile browser (which does not have a wallet) to do so using either a mobile wallet browser (Metamask Mobile Browser) or via a desktop, for now.

- Also on mobile, our popup notifications are too big, taking up most of the screen AND the ‘x’ close button does not show up.

Action: We have reduced the size of popups on mobile screens and are displaying the ‘x’ close button always, without the need for hover

- We had numerous users who ran into the issue of “1st deposit failure, 2nd deposit success” - This is a very bizarre bug, and after much investigation we are narrowing this issue down to a gas estimation issue by Metamask.

Action: A huge part of the reason why the tx for depositing/withdrawing is so high (relatively of course, looking at our ETH friends here is because we run a harvest and re-compound flow on every deposit/withdraw.We believe this makes it more fair to all depositors.However, after much observation and weighing the pros/cons, we believe we will remove this flow from deposit/withdraw in the future vault contracts and have only our keepers trigger compound on behalf of the vault.This does mean that depositors/withdrawers may not have the most fair value, but we believe this is currently negligible (in fact, saving users gas fees by half and reducing the probability of failed tx is probably saving that already!)

- We had a few users who deposited the max amount allowed, withdrew it all, and then tried to deposit the max amount allowed again but failed, saying that they exceeded their max deposit - We found out that the issue is due to a frontend error in leaving some dust in svTokens when a user clicks on ‘MAX’ to withdraw/burn their svTokens.

Action: We have since fixed this issue on the frontend, and on the smart contract side of things we have actually implemented a dust check to prevent dust from accruing for users as much as possible.

- We have had feedback from people trying to figure out how to determine how much their svToken holdings are worth (essentially, to track their P&L)

Action: We have updated the front-end to surface up an ‘svTokenExchangeValue’, i.e., how much in USD worth is 1 svToken worth now? Additionally, we also updated the frontend to display a rough estimation of how much svTokens you will get on deposit, as well as how much of the underlying asset you will receive on withdraw of svTokens We are working on a future design to be placed either in the vault details page, or a separate ‘Portfolio’ page, to display your P&L across all deposits!

- There is a request for 2 types of “token approvals”: Approve Exact Amount and Approve Large Amount

Action: We believe this is indeed a good practice to cater to more security-conscious users, and we will work to implement this along with some other UI updates to our Deposit/Withdraw section!

- Internally, we believe that the charts right now are a little too messy, especially on desktop where we combine several charts into one

Action: We will work to break up the data into multiple charts so they are clearer — in fact, this is already the case for the mobile version

- We currently show debt threshold for rebalancing vaults but not delta.

Action: We are going to display delta thresholds as well.

Market and Protocol Updates

- The price of AVAX has dropped from a day high of $14.29 on the 5th of December to $12.75 currently. This signifies roughly a 10% decrease in AVAX price.

- Additionally, TraderJoe has also reduced their JOE reward emission to the AVAX-USDC vault in TraderJoeV1 swap pool, in a drive to get liquidity and users to move towards their TraderJoeV2 swap pool using their liquidity book concept. This resulted in less transactions AND rewards for their V1 pools, resulting in a drop of fees APR, from a high of 4% swap fees APR and 8% farm reward APR to a low of 2.6% swap fees APR and 5.8% rewards APR.

- Combine that with the lending pools being utilized more as more deposits came into the vaults, which resulted in an increased borrow rate of assets from 1.7% to 5%, and you can see why the Total APR for the vaults dropped from a high of 36% on launch to roughly 17% APR right now (currently 42% at the time of this summary!).

- Despite the above though, what is the Actual P&L of our vaults? Based on current exchange rate, it would be as such:

3x AVAX-USDC Long Vault TJ

- P&L in USD Value: -8.5%

- P&L in AVAX Amount: 6.9% APR gain in amount of AVAX

- As a Long AVAX strategy vault, it has performed its goal of stacking more AVAX.

- It is also useful to note that the drop in USD value is less than if a user holds AVAX directly itself (-8.5% vs -10% drop in AVAX price)

3x AVAX-USDC Neutral Vault TJ

- P&L in USD Value: +0.0342% (compared to a 10% drop in AVAX price)

- P&L in AVAX Amount: N/A

- As a delta-neutral strategy vault on AVAX, the vault has broken even (the positive % change is small and quite negligible) despite the price of AVAX dropping by 10%. The team still understands that this can be rather disappointing though, but we attribute it partly to the fact that the underlying fees APR has also dropped significantly in the past week. “Double whammy” for us unfortunately, but we are glad that at least this vault’s strategy is yet to be losing money despite the price drop in AVAX.

- As a side note: you can track these P&L changes from inception of the vault by looking at the exchange rate of 1 svToken : x USD value in the vault’s details page, beside the name of the vault (we will be showing this value as part of the data below, soon!)

- As a second side note: you might still have lost some value depending on when you entered into the vault. Again, it all depends on the value of the vault token!

- How do we stack up to some of our competitors/alternative vaults out there? Without naming names, we have:

C1 3x Long AVAX-USDC

- P&L in USD Value: -11.2%

- P&L in AVAX Amount: -0.5%

C1 3x Neutral AVAX-USDC

- P&L in USD Value: -0.36%

- P&L in AVAX Amount: N/A

C1 is a competitor that is more closely aligned to us, and although we are glad that our vaults are performing slightly better than theirs, we are very aware that they are operating at a larger scale than our current alpha test, so it isn't a fair comparison.

C2 0.5x Long AVAX-USDC

- P&L in USD Value: -10%

- P&L in AVAX Amount: 3.8%

C2 0.5x Neutral AVAX-USDC

- P&L in USD Value: 4.2% APR

- P&L in AVAX Amount: N/A

C2 is a competitor that is performing better than us, but as the strategy is different, it makes sense as it essentially reduces the amount of exposure to AVAX (which had decreased in price).

This likely means that when and if AVAX appreciates in price, the P&L will likely be lower than a 3x leveraged vault. However, this is still something we can learn from.

- Btw, it is 100% worth noting that our Lending Pools utilization rate is around 40% right now, and lending pools are essentially "risk-off". All lending pools’ ibTokens have increased in value to their underlying asset.

What’s Next From Steadefi?

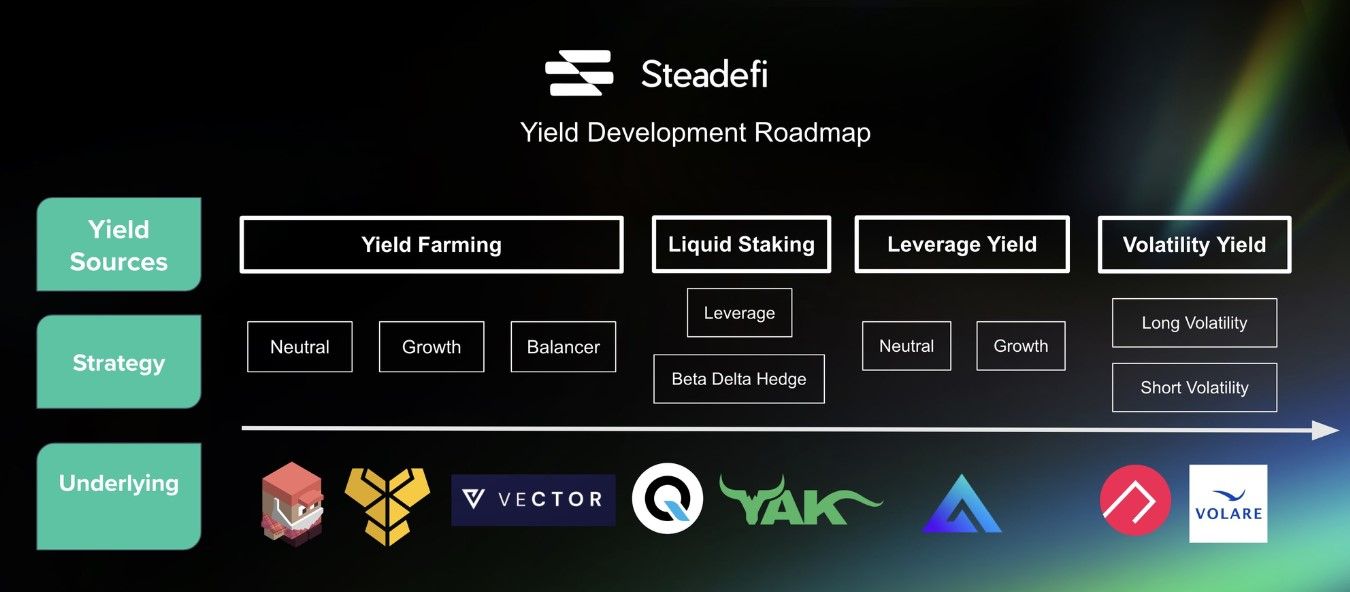

Ultimately, we know we all want more exciting yield...and the team is on it!

The current vaults on AVAX-USDC TraderJoeV1 is just the beginning and a proof of concept for us (we are only about 3 months old!).

We have more Strategy Vaults that we believe will bring about more interesting, risk-adjusted yield.

In fact, to make this more interesting…we will just share the initials here:

- P

- V

- G

Select Questions from AMA Session

"Once the vaults go live/public, will there be a capacity like during the alpha, and if so how high will it be?"

It is likely that we will have an overall vault capacity, as well as a per deposit/withdraw limit (likely to be a larger sum though). However, there would not be any per address limit.As far as estimates go, what will likely happen though is that we start with a smaller overall vault limit, and increase that slowly...Perhaps we need to implement some sort of system to give Steady Lads and Ladies a heads up first since they would be first come first serve?

"What is or was the great challenge you find building platform?”

Oh wow... where do I even start?The greatest challenge is definitely in the numerous moving pieces involved in what we do, and it's really a team working together. We have the quant team coming up and backtesting strategies. We have the engineering team converting those into engineering code execution. Not to forget the design team working on the UI/UX as well to try to make things clear! And our content team too for our docs and blog postsSince our main USP is undercollateralized leverage, we have to ensure good integration with our lending pools and vaults.. and not just code-wise, but also 'economic' wise. Last but not least, security and testing. We delayed our launch by a few days as we really wanted to ensure everything was running smoothly and well! And I must have deployed the whole protocol on testnet about 10 times before we deployed on mainnet.

"Will there be more trading pairs in the future?"

Yes! How far into the future though is another question...To elaborate more on that though, it ultimately depends on Underlying Yield Source (solid, good, real yield) + whether we can get better yield, risk-adjusted, implementing our strategy vaults to it.