Click on the tabs to read more!

General Product Updates

- We’ve pushed numerous fixes for some of UI/UX issues brought up by our community in Week 1.

→ Lending Pool charts now show the correct total supply history → Vault Details page now displays the Delta Threshold for rebalancing triggers → For mobile, we’ve reduced the size of toast notifications as well as pushing the ‘X’ close button for easily closing the notifications → Buttons for deposit/withdrawing are disabled when the input box is 0. → the svToken exchange rate and value is now displayed more prominently. → A timeframe toggle has been added to the Lending Pool and Vault charts.

- Known issue (WIP): Our charts are still a bit wonky/unclear. We will be working towards improving these over the next few weeks. The mission to make things as clear and understandable as possible for everyone!

Market and Protocol Updates

- For Week 1: the price of AVAX had dropped from a day high of $14.29 on the 5th of December to $12.75 Dec 14th. This signified roughly a 10% decrease in AVAX price. For Week 2: the price of AVAX has dropped again to the current average of $11.80, which is about a 17.5% drop overall now.

- Our Neutral Strategy vault, whose purpose is to earn yield through the AVAX-USDC swap pool as well as JOE rewards, while protecting against delta exposure to the volatile asset’s price movement (AVAX), is sitting at a slightly lower Profit & Loss of 1 3N-AVAXUSDC-TJ-AT to $0.998665 USD (-0.1335%). For comparison, if you were to have take $50.00 USDC and directly convert that into 50% AVAX and 50% USDC and contribute it to the AVAX-USDC LP pool on Trader Joe, your $50.00 USDC would likely be worth around ~$46.10 USDC for a -7.8% loss due to delta exposure to AVAX + Impermanent Loss (if you withdraw). In short, the Neutral Vault has provided some capital protection by hedging against the delta (price movement) of AVAX while earning more swap and reward fees for you by providing you leverage on top of your initial capital.

- Our Long Strategy vault, which takes a “Long” view on AVAX, has more exposure to AVAX price action and therefore has not been as well protected against the drop: 1 3L-AVAXUSDC-TJ-AT is worth $0.845386 USD for a P&L loss of -15.46% in USD value. From an AVAX amount perspective, each 3L-AVAX-USDC-TJ-AT is also worth a lower amount of AVAX than last week. For example, my 4 AVAX deposited is now 3.986472 AVAX, for a P&L loss of 0.013528 (-0.3382%).

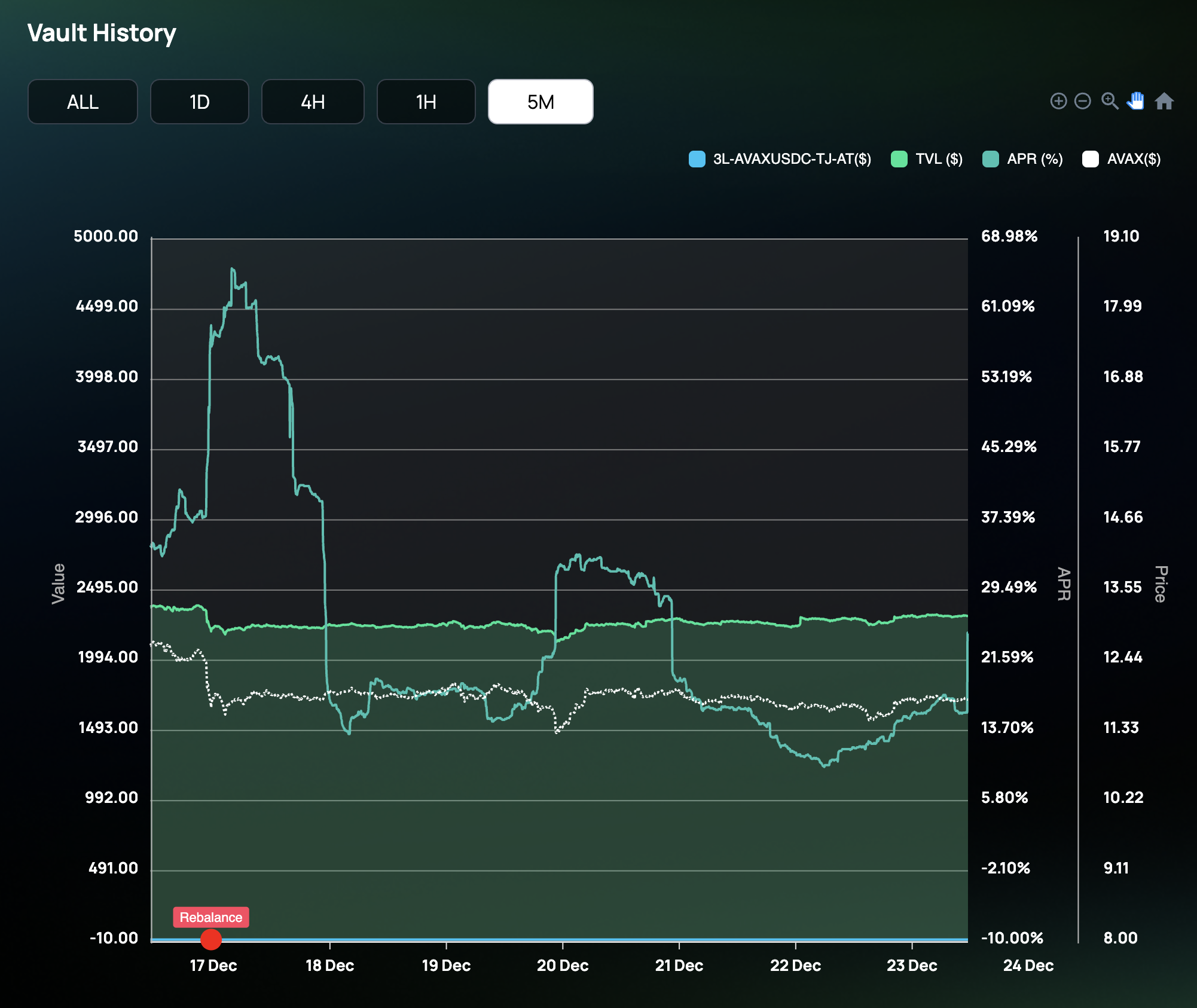

- So though the amount of AVAX lost in the Long vault is quite small percentage-wise — why would the vault even lose any amount of AVAX in the first place? The answer is simple: a Rebalance was triggered around the 17th of December 2022 at 7am GMT.

The Long Vault’s debt ratio hit the ceiling of 69% for our debt threshold, and the rebalancing kicked in, reducing the debt ratio to 66%.

In short, some amount of earnings that the vault made were used to pay back interest on the amount borrowed, and the payback ate into the initial deposits as the price of AVAX had dropped.

- Btw, if you’re looking for a more “risk-free” way to earn yield on your assets though — you should consider depositing assets to our Lending Pools! Our lending pool’s ibToken has been slowly increasing in value over the weeks. It’s not going to yield crazy high returns…but it’s steadily climbing in amount regardless of any market conditions.

What’s Next From Steadefi?

- Our Strategy Vaults are meant to help automate a particular perspective or strategy — Neutral if you believe the market is trending sideways, and Long if you believe the market is bullish. And since we are in a Bearish trend right now, neither of these two strategies would yield great P&L — at least not in the short-term. With that in mind, we will be running a community poll in Week 3 to see how many members of our community would be interested in a Short strategy vault!

- Our APRs jumped between 15-65% this week and yet the value of the vault capital dropped overall. This is where we believe we have a LOT more work to do to educate everyone on the difference between APR and actual Profit and Loss (P&L). The data must be shown in a clearer way so users can easily track the P&L over time. We are now working on a “Portfolio” page now for users to be able to track their deposits across all vault and lending pools. We are also working on a “projected” P&L value so that users can estimate how much $$$ their assets would be worth over time.

- Pangolin, GMX and Vector strategy vaults are coming! Look out for their alpha testing vaults in Jan 2023 🥳 We’re also excited to see what Steakhut is building on TJ’s Liquidity Books and we’ll be looking for a way of creating our vaults on that as well.

Select Questions from AMA Session

"How do you calculate your APRs? (And how often?)”

A few parts to APRs:

- how do we calculate them?

- how frequently do we calculate them?

- how do we have negative P&L if APR is not negative?

How do we calculate them? APRs are easy to understand, but can sometimes be a tricky business to calculate (any folks working in a DeFi project can affirm!) Basically it boils down to how much of X you are earning on Y deposits. Where X can be swap fees if you deposit Y assets in a liquidity pool or X can be reward emissions if you deposit Y assets in a stake pool/farm. As much as we can, we try to obtain these data from the blockchain/smart contract as that's the most reliable and accurate source of truth. However, the blockchain is really not the best database to store time series data...And so we end up having to rely on data/values that are given by the protocols themselves. This is especially true for reward token emissions given by the protocols themselves. Things start to get complicated when you realize too that the APR given by not always be denominated in USD... but in something else where the USD value of it can fluctuateGenerally for our current vaults which are tapping into the AVAX-USDC liquidity pool on Trader Joe, we are taking the 24h average swap fees APR as well as the JOE rewards emission APR, adding them up and multiplying them by 3 (since the vault does a 3x leverage).We then proceed to reduce the APR since there are borrow fees incurred from the leverage of AVAX and USDC.The amount of borrow interest to reduce varies from Neutral and Long vaults since the vaults borrow different amounts of the different assets.

How frequently do we calculate them? Every 5 minutes.

How do we have negative P&L if APR is not negative?APR is equivalent to earning fees (or rewards).Your deposits however, still contains assets that are volatile (AVAX in this case).The price of the volatile asset (AVAX) can still increase or decrease in price.If the price decreases sharply, the overall value of your deposits/holdings would likely still lose value (negative P&L).