In 2017, it all began with ETHLend, one of the first peer-to-peer DeFi lending platforms. Then in 2020, ETHLend adopted the “liquidity pool model” and it became…drumroll…the Aave Protocol, currently the 4th largest platform (by TVL) in all of DeFi.

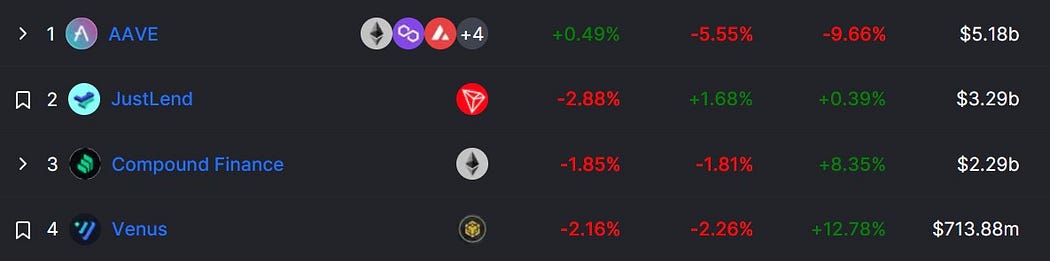

Lending and borrowing protocols, like AAVE, are both highly-utilized and necessary for the continued health of our decentralized finance systems. As of now, they hold the 2nd highest TVL on 184 different protocols around every major blockchain. And the top four lending protocols (AAVE, JustLend, Compound, Venus) dominate that TVL with over 80% of the $14.16b.

One of the contributing factors to their popularity is that lending protocols are one of the most “user-friendly” options for the majority of DeFi users.

The concept behind them is simple and deeply-rooted in traditional finance — one person supplies value and another person borrows value. Interest paid by the borrowers goes to the suppliers. If someone wishes to borrow value, they have to provide some kind of collateral value.

Just as with all of the other types of DeFi protocols, however, there are certain levels of risk and volatility that come with these lending systems. And in many of these systems, all of that risk and volatility is lumped together and shared evenly among all users.

They do not allow for personalized risk-reward strategies and they do not take into account the each user’s unique risk-reward appetite.

Steadefi aims to change this.

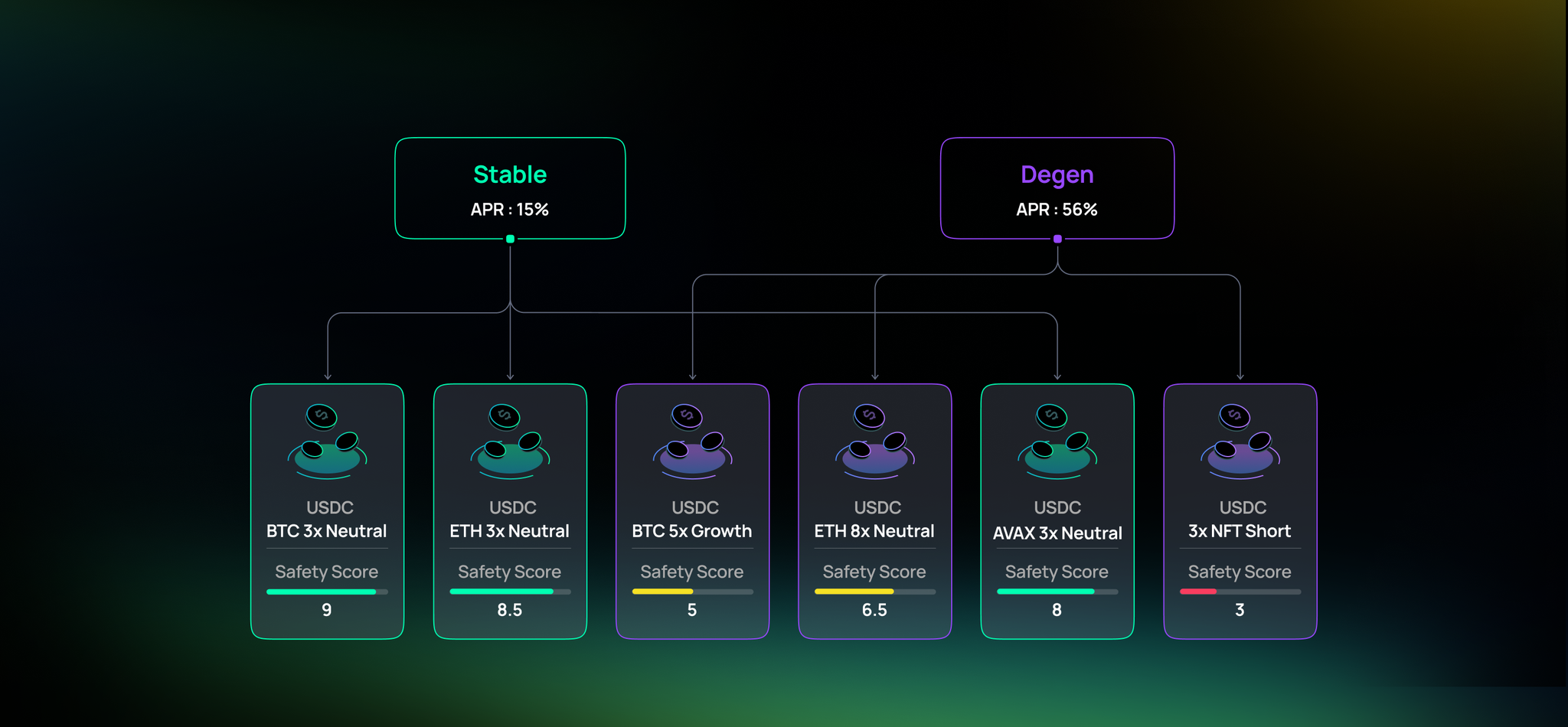

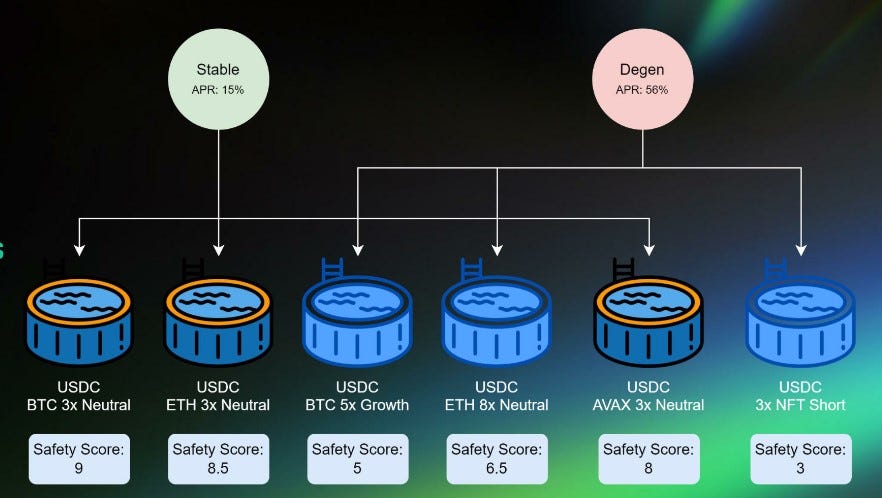

Fair Risk-Reward Distribution

Supplied assets that are being used for the highest (and riskiest) leveraged borrows should receive the highest rewards.

Supplied assets that are being used for the most conservative leveraged borrows should receive the lowest (but safest) rewards.

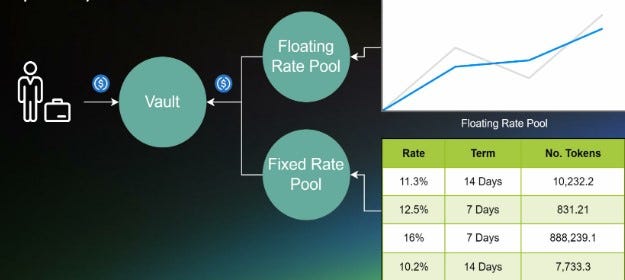

Both Fixed and Floating Yield Rates

Some users may prefer more “volatile” rates on their supply in case of sudden increases in asset utilization (one example).

And other users may prefer a “fixed” rate of return on their supplied assets which might be lower (overall) than the volatile rates, but it would at least provide some level of predictability to their earnings.

Our Steadefi team has more upgrades cooking on the fire.

Interested in learning more about Steadefi and our upcoming products?

Follow us on Twitter! https://twitter.com/steadefi

Interested in participated in our limited Q4 Alpha Testing?

Join our Discord! https://discord.gg/steadefi