As DeFi believers, we all hope to one day welcome the “uninitiated masses” to our ever-expanding metaverse.

We want these new users, not simply because their arrival would mean more value and profits for the early believers, but also because we know that DeFi can provide financial opportunities and personal control on a truly global scale.

However! — There is plenty of work to be done before this “rich utopia of global financial freedom” can be achieved.

In its current state, DeFi is still littered with problems such as “misleading expectations on yields” and “unfair risk-reward systems.”

In this post, however, we’ll be tackling some basic issues in both onboarding and retaining DeFi newcomers.

1) The Lingo

Walk up to a stranger on the street with no DeFi experience and mention the term “liquidity pair” — we already know this poor stranger’s response (“uh sorry, no spare change”).

And liquidity pair is just the beginner’s level of DeFi verbiage. There’s also leverage, automated market makers, flash loans, impermanent loss, slippage, and bots.

Nothing here is easy for newcomers (more so for non-native English speakers), and even if they take the time to master this ground-level vocabulary, it can get even worse in more advanced DeFi with terms like pseudo-delta-neutral imbalance ratios, implied volatility, and arbitrage principles.

Oof, right?

2) User-Interfaces (UI) and Position Management

As with the lingo, interacting with DeFi is also a complex beast. There are many simple platforms that allow users to click a few buttons and complete their transactions, but by in large, the more advanced the DeFi service is, the more complex its UI tends to be.

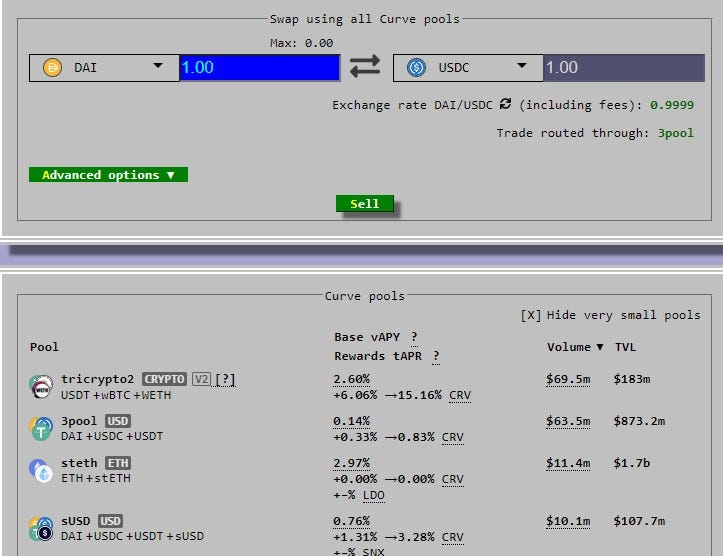

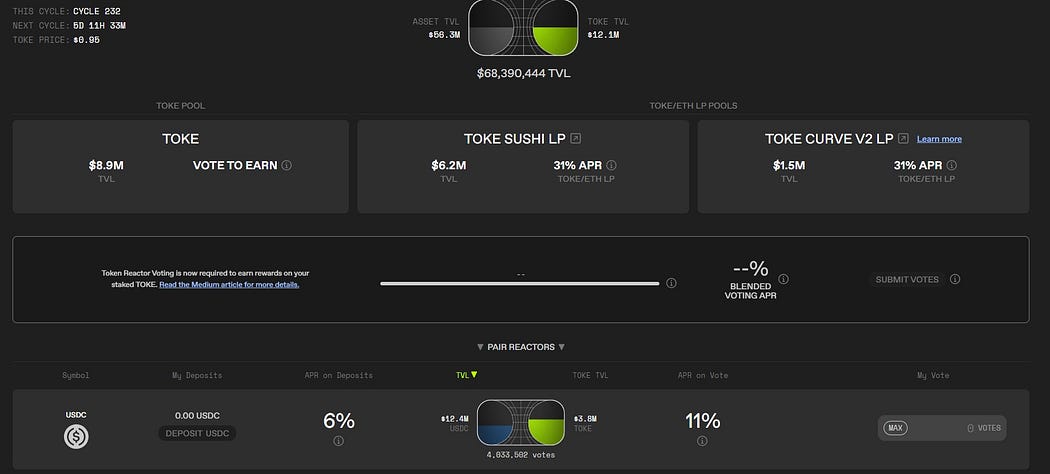

Take a quick look at these interfaces for Curve and Tokemak (two well-established protocols).

Where? How? What do we do with this?

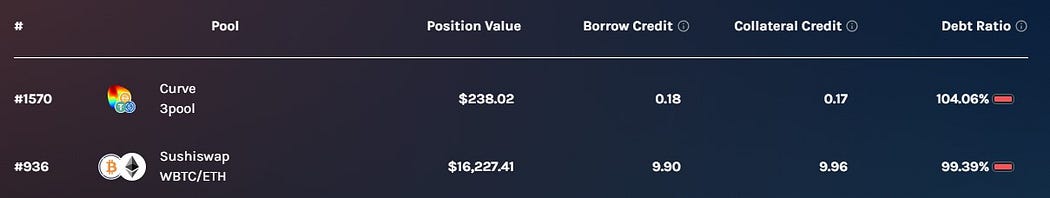

What’s more is that even after a user figures out how to interact initially with the service, they may be required to constantly manage their investment by performing weekly (or even daily) actions like compounding yields, adjusting leverage, or withdrawing/moving funds.

In the end, asking the “masses” and our grandparents to take the time to both understand and manage their investments in these complex protocols is too much.

3) Research & Analysis

Now let’s imagine our new user has mastered the lingo, figured out how to interact with a protocol, and is now willing to actively manage their position — what if they want to see the historical performance of a protocol’s features?

Instead of just looking at a snapshot of how the pool/vault looks today (as displayed above), more cautious investors need to be able to track how well a pool or vault has performed from its beginning.

Financial institutions have research staff dedicated to this type of task, but since DeFi is about providing informed opportunities to the individual sitting at home, there needs to be straightforward and intuitive ways to fully analyze the past performance of any DeFi investment, yield investments in particular.

If only there was a protocol dedicating itself to addressing all of these issues in DeFi (and more)….

Interested in learning more about Steadefi and our upcoming products?

Follow us on Twitter! https://twitter.com/steadefi

Interested in participated in our limited Q4 Alpha Testing?

Join our Discord! https://discord.gg/steadefi